Research insights from Behavioural Economists and Psychologists

If we want to accomplish long-term behavioural change in our lives then it’s important to understand how we can affect real change. What needs to happen for behavioural change to be sustainable? And, what happens when a change that’s needed is unsuccessful, or doesn't occur.

Some of the things covered in this article:

- Setting short and long-term goals

- Assumptions we might have about our decision-making

- Current research exists in this domain

BJ Fogg - Persuasive Tech Lab at Stanford University

"If you're designing for an outcome, then you're designing at the wrong place. You need to design for the behaviours that lead to the outcome." (Fogg, 2013)

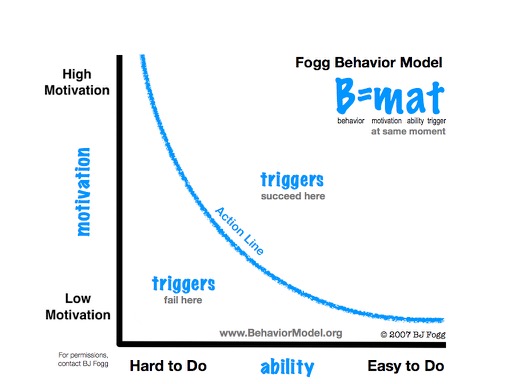

Fogg’s Behavioural Model involves 3 key things:

- Motivation

- Ability

- Triggers (i.e. calls to actions)

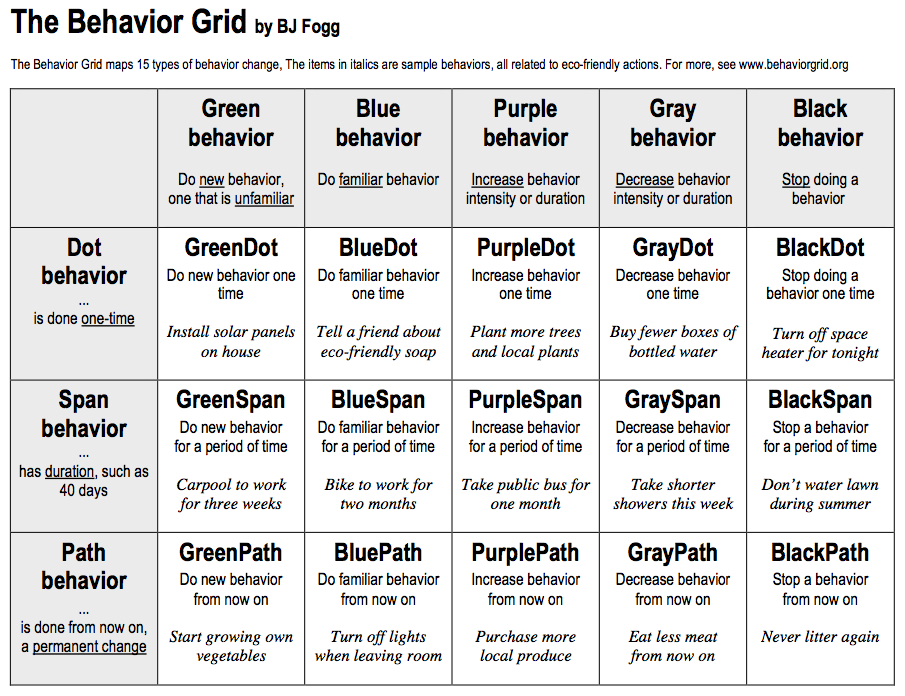

Fogg notes that motivations and ability are trade-offs in behavioural change. Fogg has studied about and modelled 15 ways behaviours can change. His Behavior Grid covers Dot change (one off small changes), Span change (short-term) and Path change (long-term). However, when it comes long-term changes then there are only 2 ways to affect real change – (1) change the environment you're in, or (2) introduce a small change to a current behaviour or habit. Social environments can be hard to change due to family and peer pressures and social norms. To succeed in a behavioural change, you need to introduce a new behaviour after an existing behaviour.

When Fogg talks about short-term in his behaviour grid, he is referring to a few weeks to two months. Motivation can give you strategies to be used for short-term changes, but it is not as good in sustaining long-term changes. Ability is also a trade-off between time, effort and the amount of self-efficacy involved.

“Tiny habits can change your life forever.”

Introduce a new behaviour after an existing frequent behaviour in order to succeed. It's all about putting the new behaviour in the right spot so it turns from a new thing into a long-term repeated habit. Look for the right spot to place a new habit.

Dan Ariely - Professor of Psychology and Behavioral Economics. He teaches at Duke University

“Our intuitions really fool us. [For financial decisions] we can make many more mistakes because we can't easily see them. Many of our economic decisions are wrong.”

We may be good at understanding our physical limitations; but we are not so good at recognising our cognitive limitations. Peer group norms can drive both optimal and sub-optimal behaviours. Emotions can influence our decisions. And these influencers can make is difficult to change our behaviours based on our intuition biases.

Where decisions are complex and difficult, people revert back to what is intuitive. It is not because people don't care about the outcome; it's because understanding the optimal decision required takes effort and can be hard. If we don't know what to do, we can sometimes end up choosing what appears to be right for us (i.e. we choose the mean-average, or less bothersome option). We can be influenced by what others have done, or what we have done previously. And this can impact an outcome in a sub-optimal way. What Ariely advocates is including 'pause moments' into our thinking to ensure we can break down complex problems into smaller parts that will allow us to take the time to understand all the options available?

We can also be irrational in our decision-making where there is a mix of time + intensity + pain (discomfort). In terms of motivation, we may interpret this as a trade-off between ease and punishment (or struggle).

“We can take money, and we can get it to fulfil other motivations. For example, we can get pride; get people to be proud in how much money they can get. We can get accomplishment. We can get competition. Money can be a substitute for all those other motivations, but it doesn't mean inherently it's about all those motivations. Human beings are complex.”

Functionally, people can have an ability to achieve some outcome or result in the short-term. But to form sustainable and lasting habits there must be a meaningful outcome (condition). If outcomes are not fulfilling then any chnage can be interpreted as futile - like Sisyphus pushing a boulder up the hill.

To reinforce on-going motivation we need to think about combining what is Meaningful with an Acknowledgment of achievement. Without meaning, a choice or outcome can become meaningless and worthless.

Where businesses and organisations are concerned, people will also value things more if they feel that products and services have been designed and built with their needs in mind. If people put effort into using a product or service, then there is more investment and endowment in usage patterns; and this can lead to something that is more appealing and habit forming.

Dan Gilbert - Harvard psychologist and author

Why do we make bad decisions? The Swiss mathematician Daniel Bernoulli formulated that the value of something depends on our ability to understand or estimate the Odds of a Gain and the Value of a Gain. Academics know this formula, but most of us haven't heard of it before. Odds are difficult to estimate in everyday life. We usually compare new odds-based situations with ones we've encountered in the past. We don't usually look at the true cost of gains or losses, as they can be hard to calculate.

“People are bad in estimating success and the value.

We can use 'fast' recall in our decision-making, and this fast recall can have profound affects on our decisions. Fast recall is easy to achieve and prone to making mistakes when comparing past situations that on the surface appear to be similar to a current situation. The alternative, which is 'slow' recall can be perceived as an effortful or strenuous thought process - one that requires lost of time, effort and attention.

We tend to ignore common patterns – even if it can have big impacts – over what is unique and novel. We can also overestimate the importance or occurrence of something that is unique, or novel, over what is common and less risky. And this strain or extra effort in 'slow' recall can prompt our impatience to reach a quick decision. We could however solve our bias of fast recall by pushing time out 'from the now' and deferring a decision of a complex task or problem until later.

|

Common |

Unique or Novel |

|---|---|

|

Large-scale Underestimated Ignored |

Small Short-term New and over-valued |

“Comparing to the past causes many problems with making good decisions. In retail customers opt for the mid-range priced items by being anchored between cheap and expensive items.”

We are also poor with our predictions; especially if a comparison is front of mind. Contexts of money can be anchored in shifting comparisons. We can also experience problems making decisions over time, as well as making decisions with a large timeframe (e.g. now is better than later; so we choose the now option). It is hard for people to be 'far sighted', so we need to reframe the future in a vivid and meaningful way - within a rich scenario - if we want to make better decisions with long-term outcomes.

Daniel Kahnemen – Psychologist and author (psychology and economics)

Kahneman writes about our two metal systems - System 1 and System 2. System 1 is linked to our limbic system and is a fast-processing system. While System 2 is a slower analytical system that requires focus to engage. We often jump to conclusions with System 1. But to get more optimal outcomes we need to invoke some 'pause moments’ in order to slow down our thinking and make more mindful decisions. However, this cannot be achieved simply by presenting facts and statistics. A more meaningful 'conversation' or interaction is needed to achieve this.

| System 1 | System 2 |

|---|---|

| Fast | Slow |

| Intuitive | Effort to interrupt |

| Looks for similarities | Analytical |

| Can become Anchored to an idea | Statistical |

| Easy to prime with examples | Looks for meaning |

| Ease of thought | Cognitive strain |

| Jumps to conclusions | Needs time to process |

| Answers the easy questions | Will examine the difficult questions |

| Short-term | Long-term |

| Loss averse/gain focused | Looks at probability |

| Suffers from the bias of endowment | Reflective |

| Coherence-seeking (looks for the simple story) | Systematic |

| WYSIATI (What You See Is All There Is) | Careful |

In decision-making our System 1 wants the simple and easy decision to be made (even if it's not an optimal one), but that may not be the best decision. So how do we train ourselves to interrupt our 'ease of thought' and slow thinking down in order to make better decisions? Reframing a problem, reflecting on possible outcomes (both positive and negative), rechecking our facts, or seeking alternative options are some of the options we could employ.

In summary

What is necessary for building successful long-term financial habits for an individual?

Tools, experience and intuition can help us to achieve basics goals, but may not address long-term needs if we don't understand and address our underlying values and behaviours.

Motivation and triggers can be used for some short-term activities, but are not ideal for achieving long-term habits (Fogg). If we want to achieve something that enables personalised successful long-term habits, we need to understand how to pair these habits with the existing everyday values and behaviours of a person.

We can be blind to some of our intuitive limitations, so we need ways to add meaningful and useful insights that will help us to pause and think about future risks and outcomes (Ariely). Where decisions are hard or complex, people sometimes look to what they decided previously in what appears to be a similar scenario. Time, effort and discomfort (impatience) can sometimes anchor people in a solution that is easy to achieve, over a solution requiring more input that will also yield a more optimal outcome. Emotions can influence our decision-making, and without recognising this we may be thwarted in our efforts to change behaviours needed to support optimal outcomes.

For long-term planning and decisions, things that are far off in the future are very hard to determine in terms of value and personal cost. To help us understand these hard decisions we need to think about more vivid and richer ways of explaining a story or problem (Gilbert). In particular, finding ways to personalise a story based on our individual values and behaviours. For example, where a common occurrence is ignored or undervalued in favour of unique events with lower impacts.

It is important to think about building moments of reflection (‘pause moments’) into activities to allow us to break intuitive flows when it is easy to jump to conclusions (Kahneman). Our intuitions are biased towards simple, coherent and easy answers; and this sometimes does not help improve a situation or achieve an optimal outcome. However, it is worth noting that simply presenting the facts or statistical data will not in itself help people to always make the best decisions.

References:

Fogg, BJ. What Causes Behavior Change? (2016)

Available at http://behaviormodel.org

Fogg, BJ. Fogg method – 3 steps to changing behaviour (2013)

Available at http://www.foggmethod.com

Fogg, BJ. Forget big change, start with a tiny habit: BJ Fogg at TEDx Fremont (2012)

Video available at https://www.youtube.com/watch?v=AdKUJxjn-R8

Fogg, BJ. The Behavior Grid by Dr. BJ Fogg, Stanford University - 15 Ways Behavior Can Change (2012)

Available at http://behaviorgrid.org

Ariely, D. Are we in control of our own decisions? (2008)

Available at https://www.ted.com/talks/dan_ariely_asks_are_we_in_control_of_our_own_decisions

Ariely, D. Predictably Irrational - basic human motivations: Dan Ariely at TEDxMidwest (2012)

Available at https://www.youtube.com/watch?v=wfcro5iM5vw

D. Gilbert, D. Why we make bad decisions (2005)

Available at https://www.ted.com/talks/dan_gilbert_researches_happiness

Kehneman, D. (2011). Thinking, Fast and Slow

Penguin Books, London